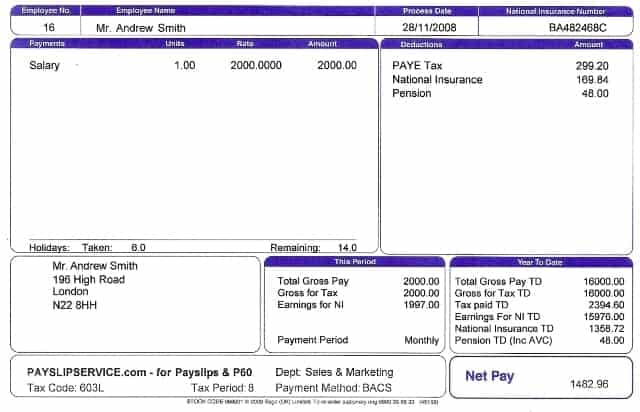

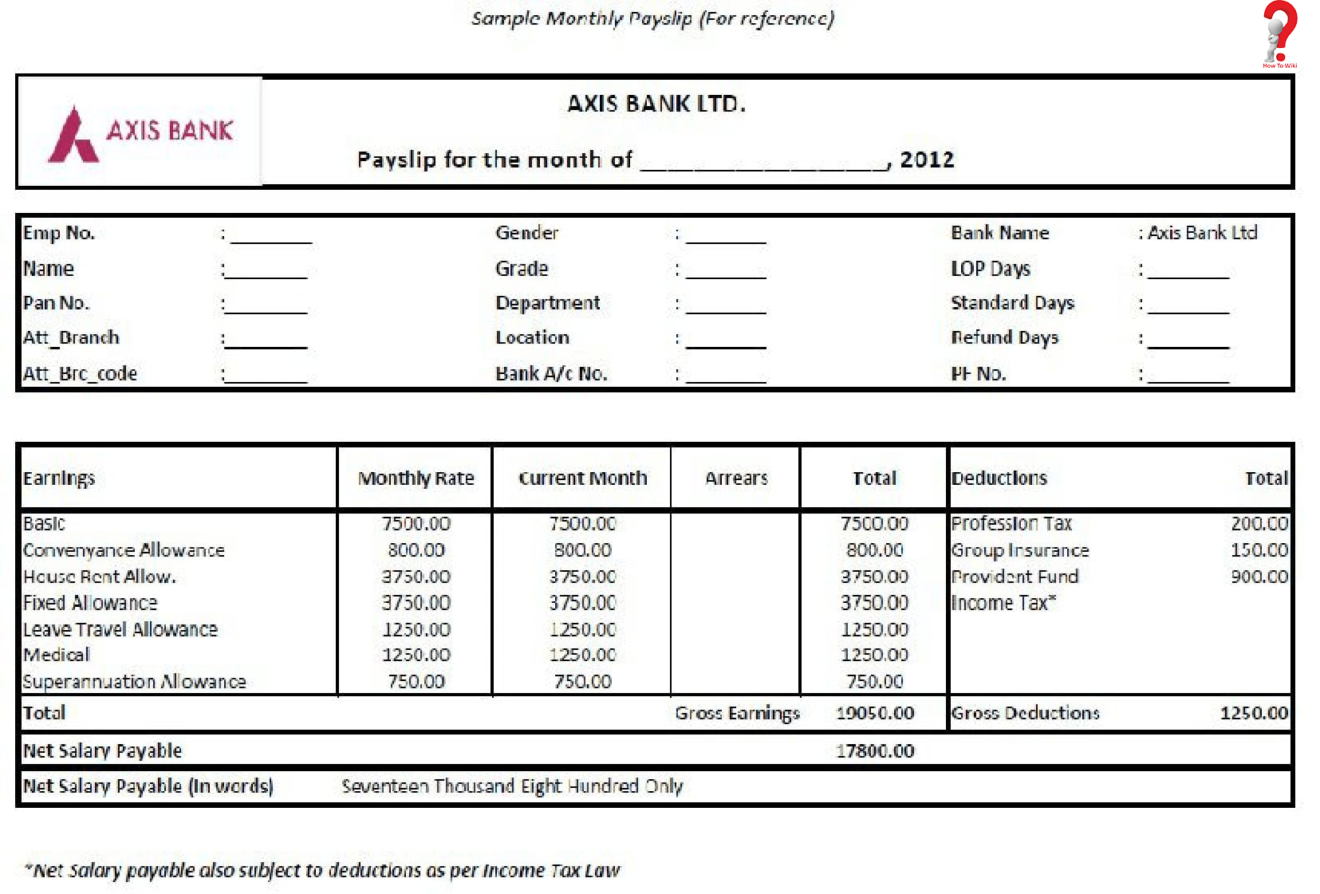

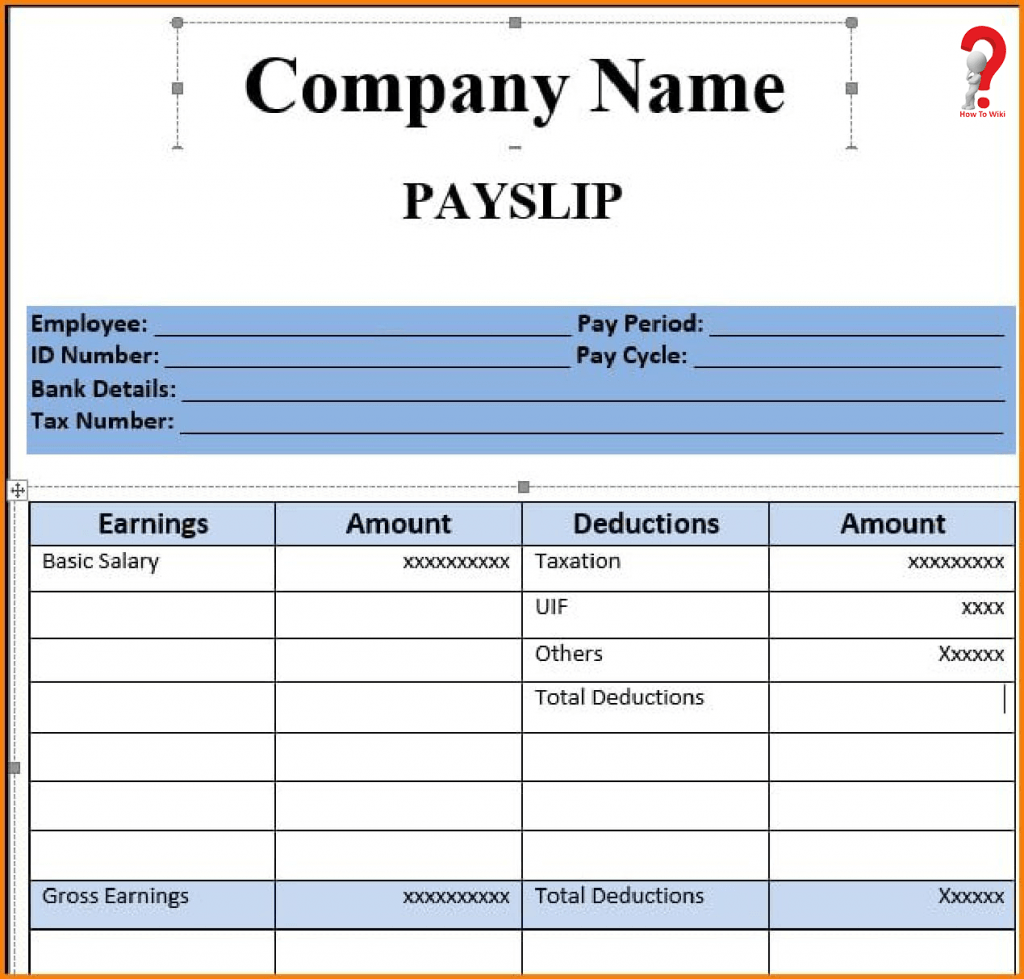

if the employee is paid an hourly rate:.employer’s Australian Business Number (if applicable).Pay slips have to cover details of an employee’s pay for each pay period. Electronic pay slips must have the same information as paper pay slips. Pay slips have to be in either electronic form or hard copy. Pay slips have to be given to an employee within 1 working day of pay day, even if an employee is on leave. What happens if pay slips aren't given or don't have the right information.Paid family and domestic violence leave on pay slips.Pay slips ensure that employees receive the correct pay and entitlements and help employers to keep accurate and complete records. Aboriginal and Torres Strait Islander peoples.Check or calculate notice or redundancy.

Bullying, sexual harassment and discrimination at work.Pay during inclement or severe weather and natural disasters.Allowances, penalty rates and other payments.

0 kommentar(er)

0 kommentar(er)